To support the Made in America initiative, SBA has introduced fee waivers for manufacturers for the first time!

Effective October 1, 2025, 504 loans to manufacturers (NAICS Codes starting with 31, 32, or 33) will have the upfront guaranty fee included in the debenture pricing and the annual SBA service fee included in the borrower’s payment and effective rate calculation waived. This applies to both “new money” 504 requests and the 504 refinance program.

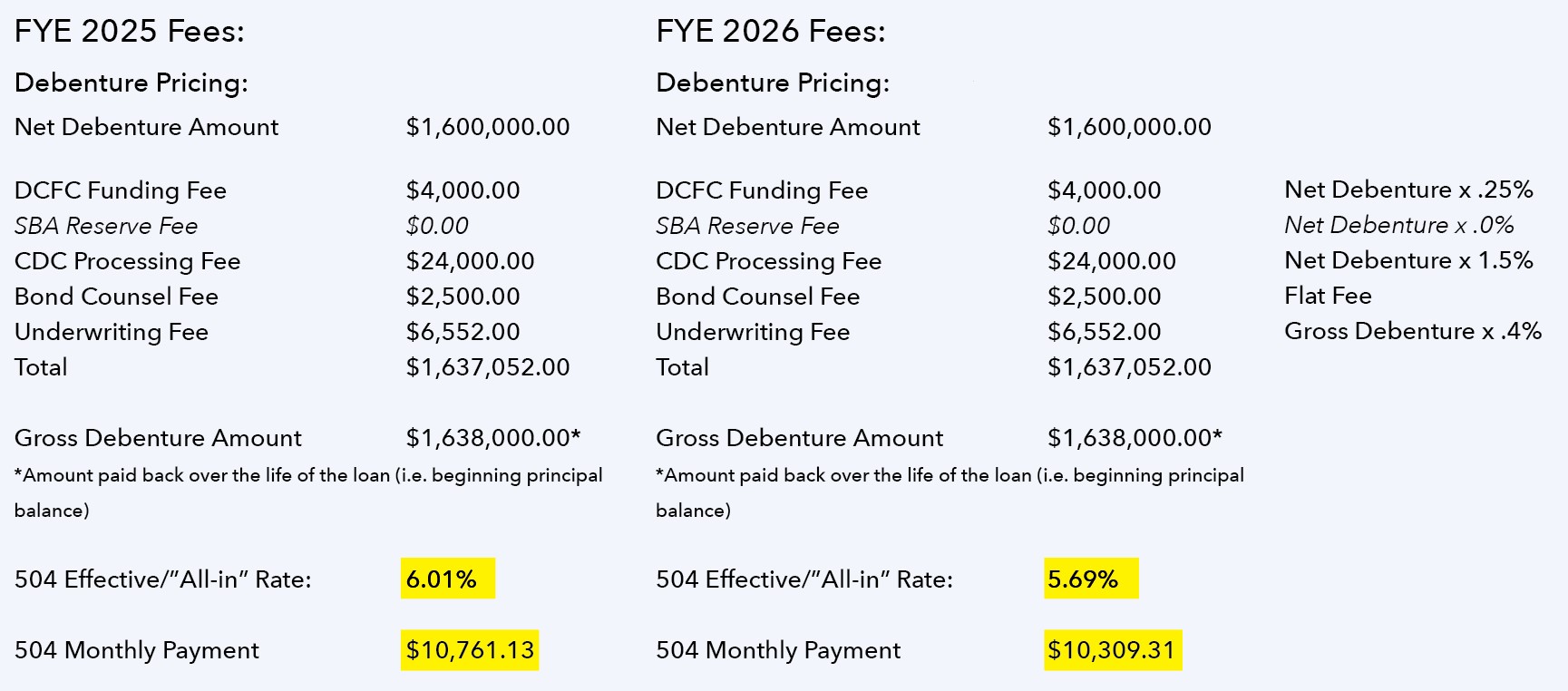

This will result in a ~30 basis point reduction in the 504 effective rates when compared to FYE 2025. With the recent downward pressure on the 10-year treasury rate, 504 fixed rates for manufacturers are currently hovering in the 5.70% range today (as of 9/12/25).

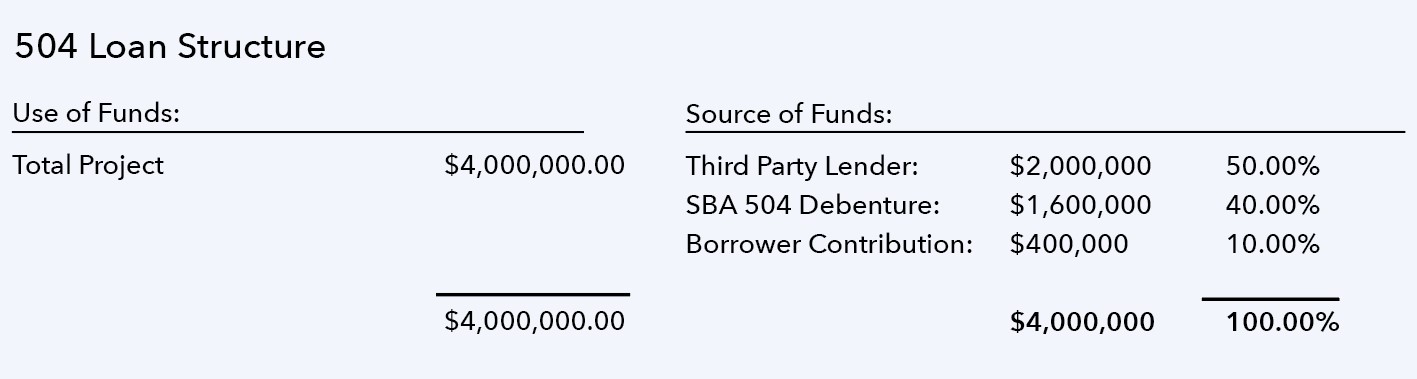

Here is an example of a $4,000,000 project to a manufacturer:

This results in over $135,000 in savings over the life of the loan!

Now is a great time to discuss upcoming expansion, equipment CAPEX, or refinance opportunities with your existing or prospective manufacturing customers!

Contact your WBD Loan Officer today to learn more!