Refinance Your Commercial Real Estate

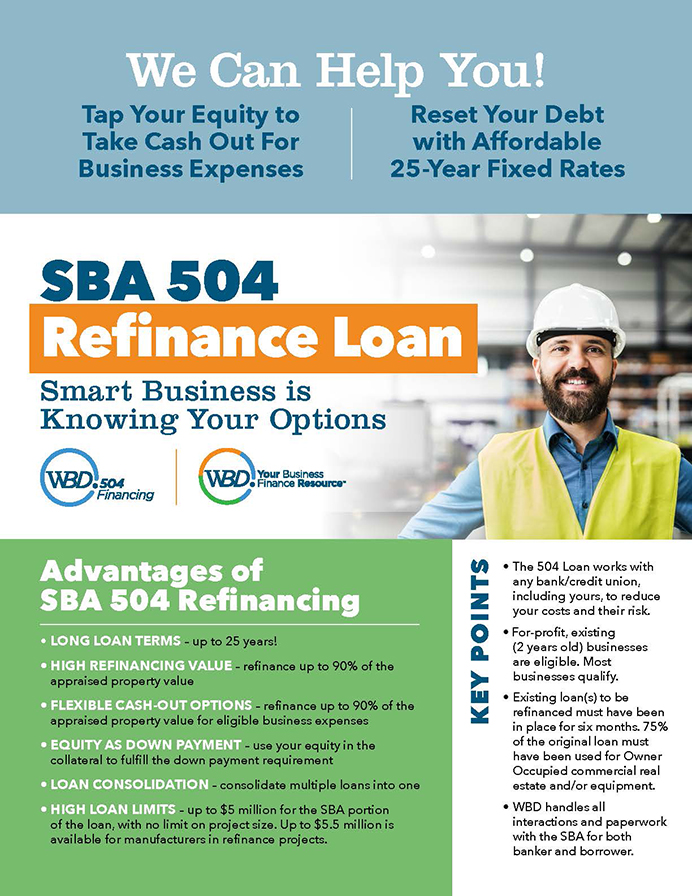

The 504 REFI Program is a powerful program to help businesses improve cash flow and access the equity of their property to pay down business expenses. And with the updated rules provided by the SBA, and with affordable, long term FIXED rates, you can’t afford to ignore this program.

To qualify for this program:

- At least 75% of the original loan must have been used to purchase or improve owner occupied commercial real estate or equipment

- The note must have been in place for at least 6 months and the final draw must have occurred at least 6 months ago

- The note has not been modified – other than renewal on the same terms- in the past 12 months

On a simple REFI you can refinance up to 90% of the appraised value, including requests for 'cash out' for other business expenses and special use properties.

To find out if refinancing with WBD makes sense for you and your business, use our handy Refinance Program Estimator.

TO LEARN MORE

- See our Smart business is knowing all your options guide to find out more about commercial financing options and the SBA 504 program

- Watch a 3 minute video on how the SBA 504 program works

- View/download our one page information sheet on the 504 Refinance Program

- View/download the WBD refinance checklist that can help you understand if you qualify (or contact a WBD loan officer)

WBD 504 Refinance Program Estimator