Leveraging the SBA 504 Program for Business Acquisitions: A Guide for Commercial Lenders

As a commercial lender, you play a crucial role in facilitating business acquisitions. One effective financing tool at your disposal is the SBA 504 program, especially when the acquisition includes real estate and/or fixed equipment (non-rolling stock). This article provides details about how to leverage the 504 program for your clients' business acquisition needs.

Inclusion of Real Estate and Fixed Equipment

When the business acquisition includes real estate or fixed equipment (non-rolling stock), layering in a 504 loan can be a great loan structuring option. This program is designed to finance these types of long-term fixed assets with long-term financing, making it an ideal choice for such acquisitions.

Structuring the Purchase Agreement

Ensure the purchase agreement for the business acquisition is structured as an asset sale. This requires the purchase price to be allocated between the various assets being acquired, such as real estate, fixed equipment, inventory, and goodwill.

Appraisal Drives the Allocation

The amount allocated to the fixed assets must be supported by a current appraisal. An appraisal on the real estate and/or equipment is required for the SBA 504 application. SBA loan approval cannot be obtained subject to appraisal, as the appraisal drives the structure of the loan.

Limitations of the 504 Structure

The 504 loan structure is limited to the fixed asset component of the sale. This means that any inventory, rolling stock, goodwill, etc., needs to be paid for or financed outside the 504 structure.

Handling Goodwill in the Purchase

If goodwill is included in the purchase, it’s important to consider whether the buyer has the additional equity to contribute or collateral to pledge. If not, the seller may need to hold back a note. Alternatively, you could potentially layer in an SBA 7a loan.

Combining 504 with SBA 7(a) Program

The 504 program can be used in conjunction with the SBA 7(a) program. WBD can assist in packaging SBA 7a loans through our 7(a) Lender Services.

Borrower Contribution Based on Experience

The borrower’s contribution to the 504 project depends on the buyer’s experience:

- Experienced Management: If the buyer has experienced management and is purchasing a going concern business, a down payment of 10% may be sufficient.

- Unproven Management: If the buyer has unproven management, the SBA will consider it a new business, requiring a higher borrower contribution, with a minimum of 15% down.

WBD will make the case in the 504 loan application, subject to SBA approval.

Special Purpose Property Rules

If the financing involves real estate, SBA’s special purpose/single-use property rules apply. If the property is considered special purpose, the minimum borrower contribution increases by 5%. Contact your WBD loan officer to help!

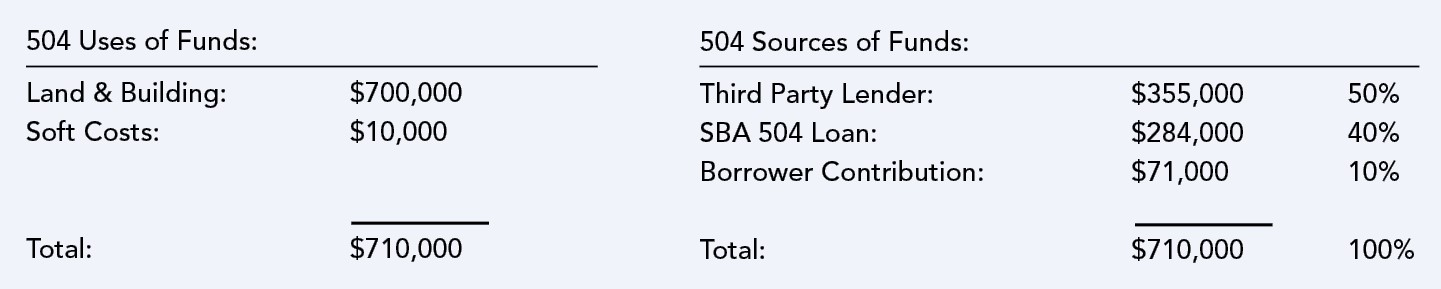

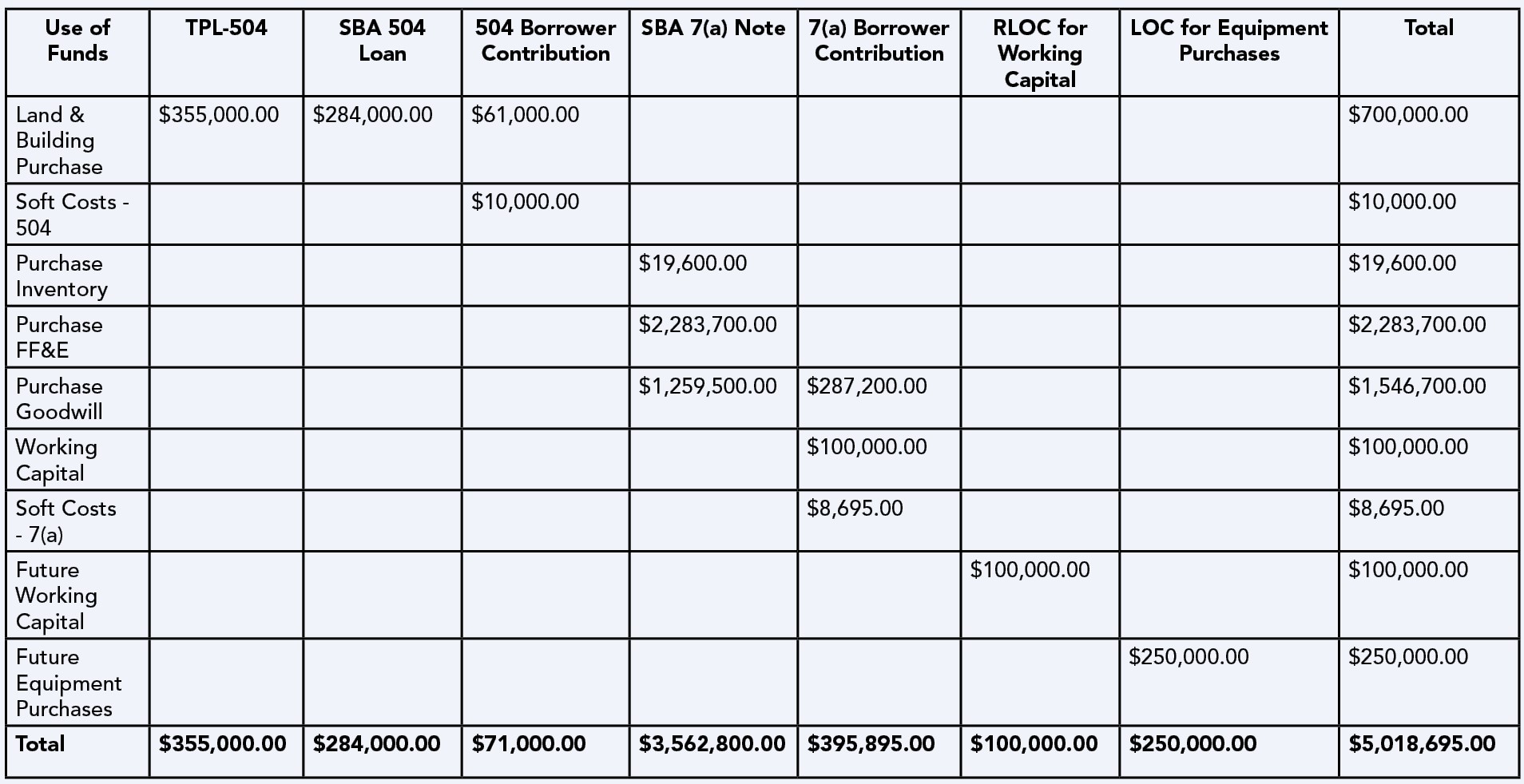

Here is an Example illustrating a combination of the 504 & 7(a) programs:

Buyer with 20 years of relevant industry / management experience looking to acquire a full-service equipment rental company. Overall purchase price was $4,550,000.

- Appraisal on Real Estate - $700,000

- Appraisal on Equipment / Rolling Stock - $2,283,700

- Purchase Price Allocated as follows:

- Real Estate - $700,000

- F&E - $2,283,700

- Inventory - $19,600

- Goodwill - $1,546,700

Both the SBA 504 and 7(a) were utilized. The 504 financed the real estate and the 7(a) financed the F&E (due to the rolling stock), inventory and goodwill. Participating lender provided a RLOC and Guidance LOC for future equipment purchases. The revolving line of credit could also be structured as an SBA Express Line.

504 Structure:

Overall Financing Structure:

Expert Assistance from WBD Loan Officers

WBD’s loan officer team has extensive expertise with both the 504 and 7a programs and can provide valuable assistance with structuring ideas. If you have a borrower with a Letter of Intent (LOI) on a business acquisition, contact your WBD loan officer to determine if a 504 or a 504/7a combo is the right fit.

By following these guidelines and leveraging the expertise of WBD loan officers, you can effectively use the 504 program to finance your clients' business acquisitions, ensuring a smooth and successful transaction.