Did You Know? Not all SBA programs are the same.

Compare the 504 Loan to the 7(a) Loan to See the Advantages of the 504.

Did You Know? Not all SBA programs are the same.

Compare the 504 Loan to the 7(a) Loan to See the Advantages of the 504.

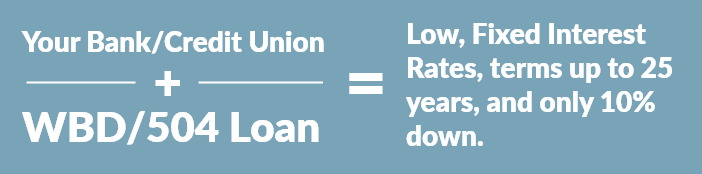

The U.S. Small Business Administration (SBA) 504 loan program is a unique financing option that can be used to finance fixed assets such as commercial real estate or equipment. Low, fixed interest rates are available for up to 25 years with down payments as low as ten percent.

The 504 loan works in conjunction with your local bank, resulting in a financing structure typical to a conventional loan, but with:

WBD makes it easy for our borrowers by handling all interaction and paperwork with the SBA. Contact WBD or ask your lender about the SBA 504 program, because good business is knowing all of your options.

Tired of paying rent to someone else? Want to build equity for the future?

Buy your building with as little as 10% down and great long term rates!

Your current space is not quite right and it is impacting your business opportunities.

Build yourself a new facility and lock in low rates for the next 25 years!

You own your own building and would like to refinance for lower payments and/or to tap some of the equity to use in growing your business.

Refinance with the SBA 504 program and lock in lower rates for the next 25 years, while accessing up to 85% of your equity for business purposes.

Your business needs expensive equipment to expand and you want options to leasing.

Purchase the equipment and get low, fixed rate financing for 10 years or more.