WBD's Lender Servicing Team Can Help You Build a Successful SBA Lending Program that:

- Improves consistency, quality and outcomes

- Moves SBA lending from a fixed cost to an incremental cost

- Eliminates the dependence on one or two key individuals to keep abreast of SBA rule changes

- Increases your capacity

- Leverages the experience of some of the best SBA talent in the business!

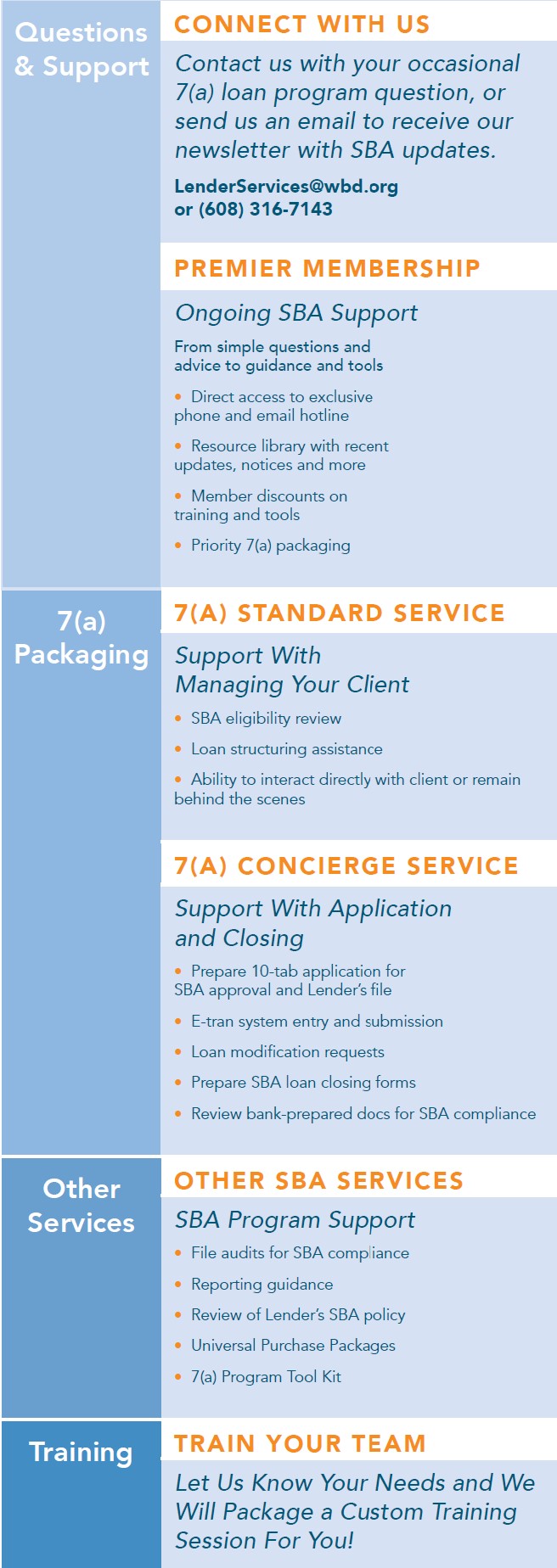

With WBD's SBA experts on your side, we offer support for any of the services you choose - from answering your occasional question to 7(a) concierge service to training your team how to work with SBA the right way. Here's how we can support you:

Put Over 100 Years of SBA 7(a) Lending Experience to Work For You!

- We are among the most knowledgeable 7(a) staff members in the region having assisted over 80 Lending Institutions during the past several years

- WBD is among the largest SBA Certified Development Companies in the country with an SBA 504 loan portfolio in excess of $1 Billion

- Vast experience working with numerous industries involving countless financing and servicing requests. We will gladly share our insight and offer workable solutions to your specific situation.

- We are ready to serve you!

Financial Institutions Across Wisconsin and Minnesota Have Put Their Trust in WBD's Lender Services

"Our collaboration with WBD has been outstanding, serving as a valuable resource for inquiries, facilitating the completion of SBA 504 loans, and aiding in 7(a) packaging. They consistently demonstrate expertise, responsiveness, and punctuality, ensuring our projects stay on course. The WBD team not only contributes supplementary internal knowledge but also assists with intricate projects when needed. Across the board, WBD delivers professional and top-notch services."

Cody

Bank First

"Working with WBD has resulted in a more efficient SBA program and helped us make better decisions with faster turnaround times.”

Morgan

Park Bank

"WBD makes all we do a lot more simple. They are available at any time to answer any questions we may have and provide real-life scenarios to help us get to funding with the SBA. WBD reviews our internal procedures to make sure they line up with what the SBA guidelines while making the process more streamlined. They are very efficient and timely in working within the parameters of our bank's procedures. Because of this we are able to close on our SBA deals quicker than ever before."

Drew

Fortifi Bank

Meet Our Team

|

Becky Schneider Lender Services Manager Office (920) 966-1483 Email: bschneider@wbd.org |

|

|

Jill Faber Lender Services Manager Office (715) 598-6049 Email: jfaber@wbd.org |

|

|

Tiffany Burnett Senior Lender Services Specialist Office (920) 966-1486 Email: tburnett@wbd.org |

|

|

Vicki Stone Vice President, Servicing Manager Office (920) 966-1494 Email: vstone@wbd.org |

|

|

Wenda Roycraft Senior Vice President and Chief Credit Officer WBDSC President Office (920) 966-1478 Email: wroycraft@wbd.org Contact Wenda for all of your Lender Services questions. |

|

|

Jason Monnett President Office (920) 966-1479 Email: jmonnett@wbd.org Contact Jason for your SBA 7(a) training questions |

|

How to Get Started:

- Your WBD Loan Officer can connect you with our Lender Services Team, or

- Reach out directly to any of our Team Members listed above or in the contact information below.

Step 1:

Establish a Lender Service Provider Agreement (LSPA). We have approximately 100 LSPAs in place with over 80 active clients. There is no cost to have an LSPA in place even if you do not have an immediate need.

Step 2:

Once an Agreement is in place, our Team is ready to initiate your projects at any time at (608) 316-7143 or LenderServices@wbd.org.

Download our Lender Services brochure to find out more information and services our team offers.

See the benefits of our Lender Services Toolkit, which can help you navigate SBA projects, creating a consistent underwriting process and avoiding delays on getting SBA approvals as quickly as possible.