As bankers, you see a lot of different business situations. The key is to recognize how to best position your customers for success. Often businesses growing quickly face a number of challenges. And while there is always more than one way to approach a challenge, don’t forget to think about how an SBA 504 loan can help your customers be positioned for long term success.

Let’s look at a scenario that is fairly common, that lays out how to utilize the SBA 504 loan to refinance and reposition this customer for success.

- Scenario:

- Your customer has been growing rapidly. As sales have reached record levels so too have the working capital demands from ever increasing inventory and receivables levels. The company’s line of credit, once a seldom used facility, that would rest half the year and never reach its limit, hasn’t rested in 18 months, and consistently hovers near its limit. You have increased the line a couple of times – both being stressful requests that required quick action. Your borrower, despite all the good feelings that come with record sales and profits, reports he is not sleeping well.

- What to do?

- You discuss your options with the borrower and your credit team. The conventional thinking is “term out the line over 5 years,” but perhaps there is a better solution that is a bit more cash flow friendly and allows everyone to get a good night’s sleep. Let’s explore this 504 refinance project:

- Existing debt structure and facts:

- $350,000 Line of Credit - fully funded.

- $1,100,000 first mortgage Term Loan

- New real estate appraisal - $2,000,000

- How can WBD assist?

- With the 504 Refinance Program, “qualified debt” (see definition below) can be refinanced. Additionally, the borrower can access real estate equity (i.e., get cash out) to pay off/down a line of credit or pay operating expenses (e.g., payroll, utilities, inventory costs, etc).

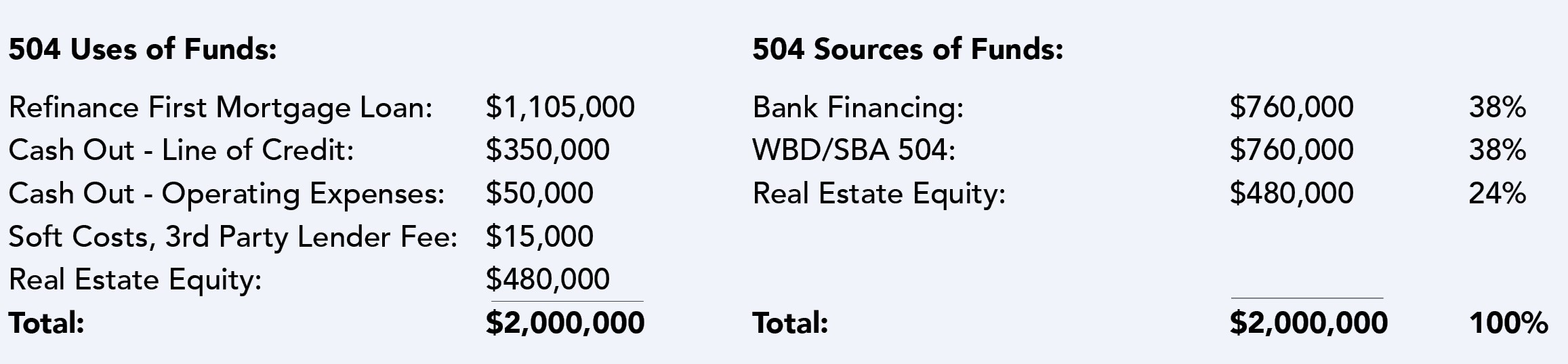

Let’s see how it worked for our borrower:

- The $2MM appraisal drove the project and the rebalancing of the company’s balance sheet.

- Cash out is limited to a maximum of 20% of the appraised value or $400M in this case which was used as follows:

- Pay off the locked in line of credit ($350M)

- Provide an additional $50M for future operating expenses (defined as expenses coming due within 18 months).

- Refinance existing mortgage - $1,105,000. This debt met the SBA definition of “qualified debt” as it originated at least 6 months ago, and at least 75% of the original proceeds were used for 504 eligible expenditures.

- The equity is plug figure equaling the appraised value less the refinanced loan, cash out, and soft costs.

- Cash out refinance projects are limited to an 85% LTV. This project’s 76% LTV allowed the final structure to be comprised of equal parts Bank and SBA 504 financing.

Final Observations:

- The restructured debt included a 10-year note, 20-year amortization for the bank portion and 25-year SBA debenture locked in at a below market interest rate.

- The structure allowed the borrower to reset its line of credit to zero without stifling cash flow.

- The restructure also allowed the banker and borrower to get a good night’s sleep.

Are you working on a customer that could benefit from a rebalance of their balance sheet? If so, please contact your WBD loan officer to explore the 504 solution.