WBD and the 504 can help!

Do you know a small business owner who financed their real estate or heavy equipment with an SBA 7(a) guaranteed loan in recent years? Many SBA 7(a) loans are priced at the Prime Rate, plus 2.75%. Prime was 3.25% from March of 2020 until March of 2022, and 6% was a decent short-term rate. However, the pricing for most SBA 7(a) loans is variable, and when the Prime Rate jumped by more than 4% in less than a year, that 6% rate jumped to over 10%!

WBD recently partnered with a La Crosse-area bank to refinance a business’s large SBA 7(a) loan, originated by a different bank. In less than twelve months, the borrower had seen their monthly loan payment increase from about $18k to more than $25k, with further increases expected!

Though bank and 504 rates had increased in 2022/2023, by re-amortizing the borrower’s debt and utilizing the SBA 504 program, the borrower’s new monthly debt service is back below $20k. In addition, the 504 portion is fixed for 25 years at a rate that’s well below Prime! The borrower is also SBA 504-approved for an expansion project that starts in 2023, and the cash flow savings will be especially important for a business in growth mode.

In order to use the 504 Refi program we must be able to show that the customers’ payments will be reduced by at least 10%. Given today’s rates, the result is often much better.

While not all SBA 7(a) loans are eligible to be refinanced via 504, many are, and WBD loan officers can help bankers and borrowers determine eligibility. You can check out our 504 Refinance Eligibility Checklist here or just give us a call to discuss your project.

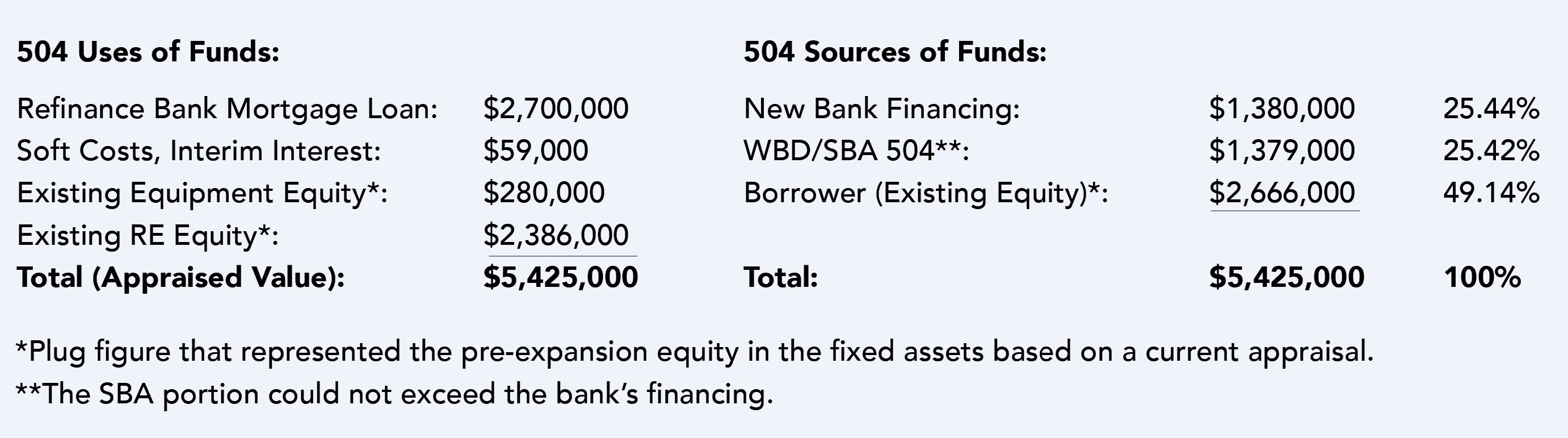

Here is a look at the details of the project: