WBD often partners with bankers to work with borrowers who are looking to transition ownership of their small business. Typically, many of these businesses are owned by multiple partners with varying timelines for retirement, or have plans to transition to other ventures, so partner buyouts are very common. And when those partners are ready to continue running the business while others want to sell, it can be a financial challenge for them to buy their partners out. With the 504 loan, those challenges can be overcome, including limiting cash flow interruptions, which is often the biggest hurdle to jump over.

Business and partner buyouts often include stock purchase transactions, which are desired for tax benefits. While stock purchases for operating businesses do not work well for the SBA 504 program, the SBA 7(a) program can assist in those cases. However, if there is a building involved in the buyout, the SBA 504 program can provide the financing, whether that transaction is structured as the purchase of the interest in the real estate holding company or asset sale.

By using the 504 Program to finance this type of real estate buyout, the remaining owner gets credit for their equity in the real estate. For those partners who may not be able to purchase the business because of limited cash flow, this is the perfect solution. In these cases, the remaining partner doesn't have to inject any cash, while also getting the benefit of the 20 or 25 year fixed rate that the 504 program offers. It's a win-win situation!

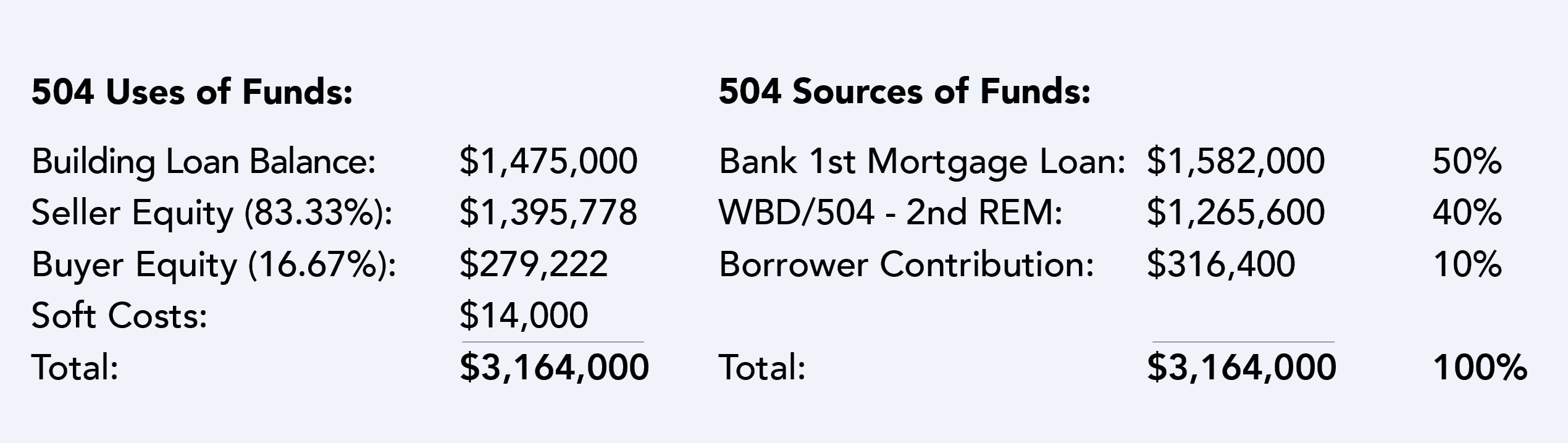

A recent 504 business buyout project example is illustrated below:

WBD's borrower/buyer had 100 percent ownership in the operating company (business) but only 1/6 or 16.67 percent ownership in the real estate. The 504 project allowed him to acquire full ownership of the property with minimal cash contribution, as shown below:

- Current appraised value of $3,150,000 and existing loan balance of $1,475,000 results in $1,675,000 in total equity in the property

- Our ‘buyer’ gets credit for his 16.67 percent of the equity - or $279,222. This comprises the vast majority of the required 10 percent 504 borrower contribution.

- The seller receives a buy out of his 83.33 percent share of the equity - or $1,395,778

- The existing loan balance is retired and replaced with the new 504 loan structure

The resulting 504 structure is:

For more information on business and partner buyouts using the SBA 504 loan, contact a WBD loan officer to help guide you through the process. We stand ready to help you with your client's financial needs and goals.