Over the past few years appraisals have been causing more than a few problems. Generally, the trend is for appraisals to come in short. As lenders, this can cause some problems. Fortunately, the SBA 504 program may be able to help. Let’s take a look.

- Appraisal shortfalls are not a new topic but the frequency of these shortfalls, and the magnitude of them, have been increasing.

- Why are appraisal issues on the rise?

- Rising material costs, labor shortages, and supply chain issues have all contributed to rising costs. Add rising interest rates into the mix and the result is often a mismatch of cost vs. value

- Think about this scenario - your appraisal has arrived three days ahead of schedule but it's $250,000 short of the cost to construct. Now what?

- Often the quick answer to your customer is, "you'll need to put more cash into your project and or scale the project back - maybe consider an open-air concept!" Easy for us to say, not so easy for the borrower to hear or do.

- While it is likely the borrower may have to increase their contribution, let’s explore some ways to lessen the magnitude of this while keeping the project alive and the borrower testimonials positive.

- Often the quick answer to your customer is, "you'll need to put more cash into your project and or scale the project back - maybe consider an open-air concept!" Easy for us to say, not so easy for the borrower to hear or do.

- How can a lendor or advisor assist?

- First - think SBA 504 and preserve your borrower's cash.

- The reduced upfront borrower contribution compared to conventional financing (10% vs. 20% or more) preserves their cash for the unforeseen, including appraisal issues.

- Plus, the 504 program, as we will see below, provides some flexibility in dealing with these appraisal shortfalls.

- How can WBD assist?

- The SBA 504 program allows some leeway for cost overruns and appraisal shortfalls. Specifically, the 504 program requires the appraised value be at least 90% of the 504 project real estate costs (recently relaxed from 95%). This buffer can have a meaningful impact on final structure.

Let's look at a construction project that almost fell through upon receipt of the appraisal, but thanks to WBD and the SBA 504 program, it came through!

Project Overview:

- New Building Cost - $2,000,000

- Appraised Value - $1,750,000

- Shortfall - $250,000

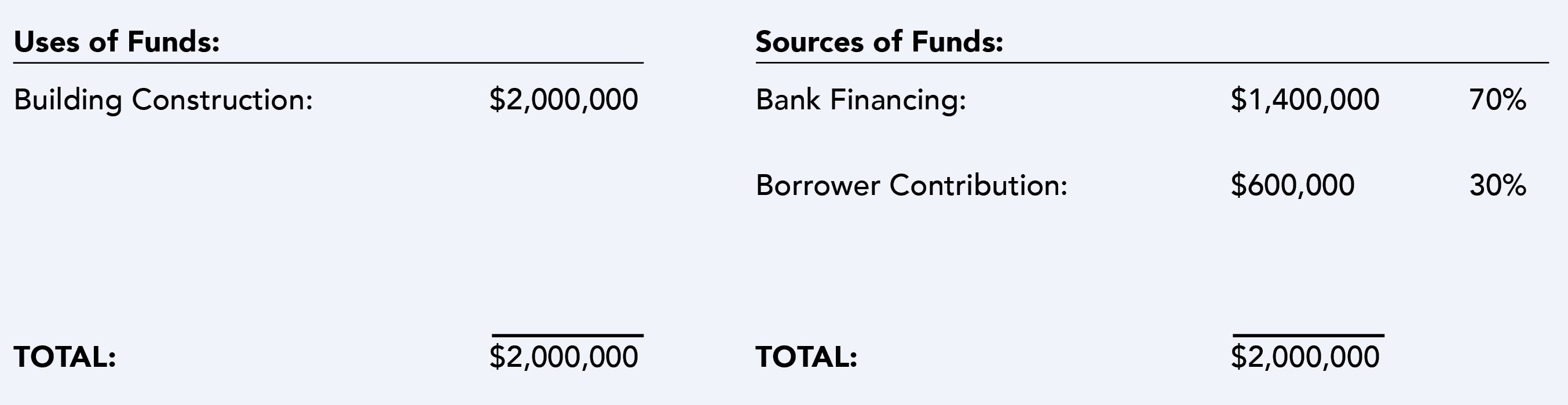

Initial Scenario: Conventional "80/20" financing

- Borrower Expectations -

- $1.600,000 bank loan (80%); $400,000 borrower contribution

- Revised Project -

- $1,400,000 bank loan (80% of the lower of cost or appraised value); $600,000 borrower contribution

- As illustrated below, the 80/20 conventional package turned into a 70/30 package upon receipt of appraisal

Observations:

- The initial borrower/lender discussion was focused on a “simple” conventional structure that got complicated when the appraisal dropped into the lender’s inbox.

- They discussed other options such as leveraging the borrower’s home and vacation home (always a fun topic to broach), utilizing the borrower’s line of credit to meet the increased equity requirement (never a good idea), as well as exploring a SBA 7(a) loan (which brought them back to the fun topic of pledging the home and vacation home).

- At this point the borrower was thinking her new building, which had already received accolades in the local media, wasn't going to be built.

- Then they reached out to WBD to discuss 504 options…

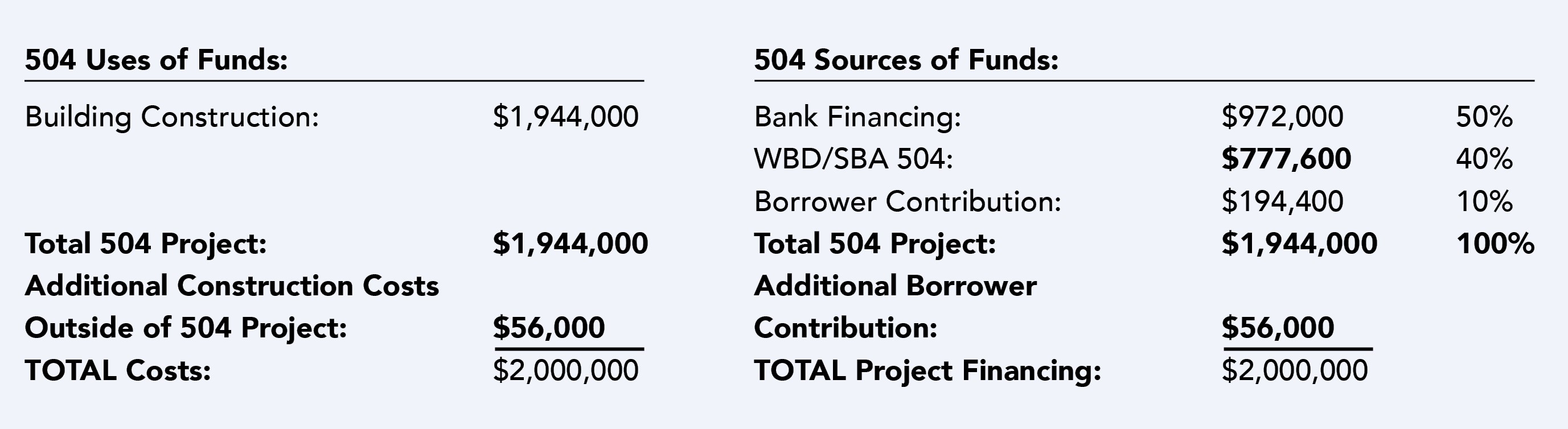

Final Scenario: SBA 504 - 50/40/10% structure utilizing the 90% cost leeway

- Borrower Expectations-

- Bank loan $1,000,000 (50%)

- SBA/WBD 504 $800,000 (40%)

- Borrower Contribution $200,000 (10%)

- Revised Project –

- Utilizing 90% leeway allowed by the SBA the structure was revised into a $1,944,000 project (appraised value of $1,750,000 divided by 90%) for a final structure as follows:

Observations:

- Typically, WBD would be involved early in the project discussions, and we would discuss the 10% or $200,000 contribution subject to an acceptable appraisal.

- In this scenario, we benefited from knowing the appraisal shortfall at the onset and structuring the project and managing the expectations from day one. The borrower understood their borrower contribution was going to be $250,400 ($194,400 plus $56,000).

- As illustrated, coming up short on an appraisal may not spell the end of a project. With upfront discussions your borrower’s expectations can be better managed and you can leave those dicey discussions regarding mortgages on homes or an extra $200,000 into the project to your competitors.

Final Thoughts:

- When addressing appraisal shortfalls, the SBA 504 Program has flexibility which historically been reserved for cost overruns surfacing at the end of the project. In today’s environment we often need to utilize this tool prior to the project’s start. Keep in mind, cost overruns are still possible so the lender and borrower will need to have a plan if they occur.

- Utilizing the SBA 504 program from the start makes a lot of sense. Call us early and often. We would love to assist.

Are you working on a project that is appraised-value challenged? If you are working on a project that requires an appraisal you may very well be working on such a project. Contact your WBD loan officer to explore the 504 solution.