The 504 program is known for providing long-term fixed rate financing, a significant benefit to borrowers. But sometimes it’s the program’s other benefit that’s most meaningful to business owners – the low down payment requirement.

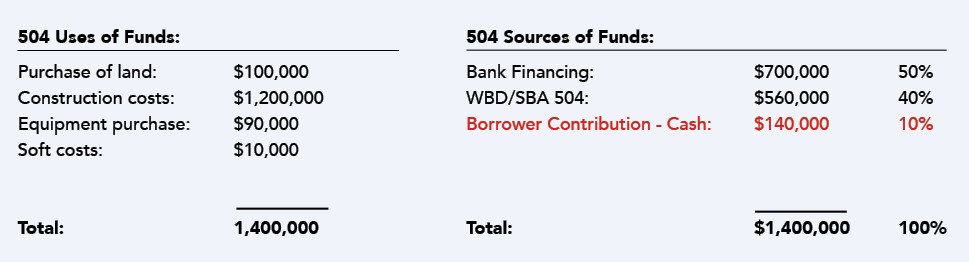

In many cases, 20% equity via conventional financing simply isn’t an option. 504 to the rescue, with 10% as the starting point! Even for borrowers who would have the ability to pledge 20%, the option of preserving cash for operating needs is often preferred.

But wait, it gets better! There are a number of scenarios where a borrower can inject even less of their cash, and we’ve included a few examples in Scenarios 2-4 below.

Scenario 1: Standard 10% down

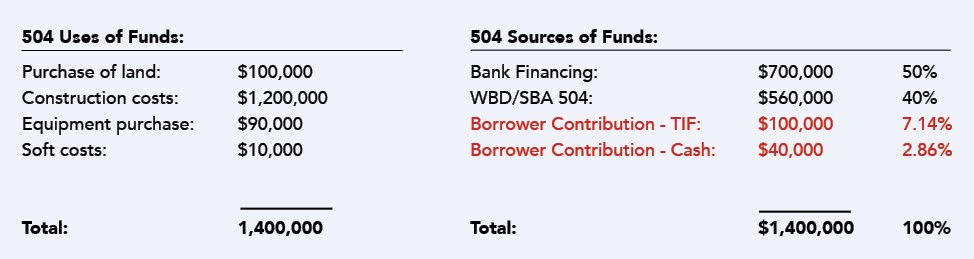

Scenario 2: TIF funding covers $100,000 of borrower contribution

In this scenario, a municipality is offering TIF for a business to locate in their industrial park. The key is to obtain a copy of the Development or Developers Agreement up front, but if the city is willing to cover the land, infrastructure, etc., the TIF amount may qualify as 504 borrower contribution.

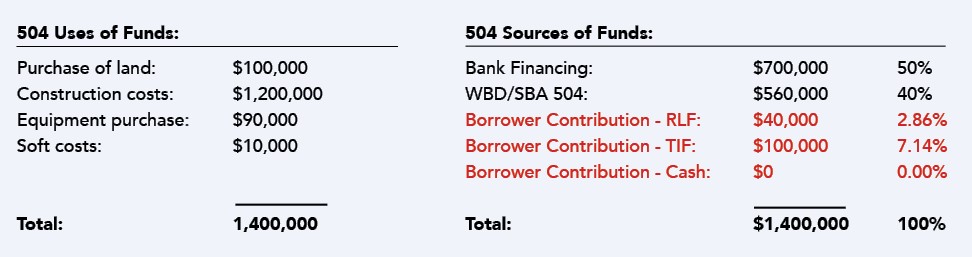

Scenario 3: TIF funding and Regional Loan Fund cover all borrower contribution

Here, a municipality or local economic development agency may have its own revolving loan fund. Depending on the terms, those funds may also qualify as 504 borrower contribution.

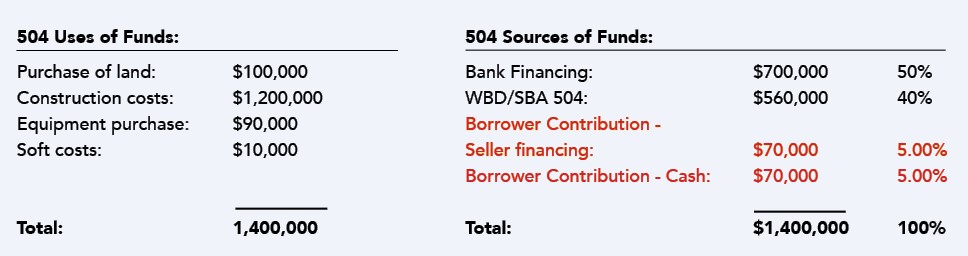

Scenario 4: Seller Financing covers some borrower contribution

This scenario includes the purchase of an existing building and equipment, the seller may be motivated and willing to provide financing. And if the seller does not secure their note with a lien on project assets, their financing is eligible as 504 borrower contribution.

Even in Scenario 1, the 10% cash contribution results in 90% financing, so scenarios 2-4 result in a more leveraged transaction. However, WBD and the SBA are cash flow lenders, so if the cash flow still makes sense, we’re not afraid to be creative when it comes to 504 Borrower Contribution.

Contact your WBD loan officer to discuss any projects that may benefit from the many faces of borrower contribution.